Singles Health Insurance made easy – and rewarding

Qantas Insurance makes it easy for you to manage your health insurance policy. Plus if you’re switching, we’ll look after all the paperwork.

You’ll also get rewarded with Qantas Points when you join, when you pay your premiums, and when you track your fitness activities through the Qantas Wellbeing App.

Earn up to 70,000 Qantas Points for joining by 9 April. Points will be awarded based on your level of cover over 6 months. Eligibility criteria and T&Cs apply.

Earn 1 Qantas Point per $1 spent on your premium every month.

You could earn 12,000 Qantas Points in a year with the Qantas Wellbeing App by walking 10,000 steps each day and regularly reaching your sleep goals.

Your health insurance cover options for singles

Explore our Hospital and Extras covers.

Why switch to Qantas Health Insurance for singles

No surprises

Minimal paperwork

Most of the paperwork will be taken care of for you, so you don’t have to worry

Claim online

Claim on the go for most Extras either online or via the Qantas Wellbeing App

What is health insurance?

What is Hospital cover?

What is Extras cover?

Helping you understand health insurance...

All Australian residents pay a contribution towards the cost of running Medicare, our national health care system. It’s called the Medicare Levy and is paid in addition to the base tax you pay on your taxable income.

The Medicare Levy Surcharge (MLS) is a tax paid in addition to the Medicare Levy if you don’t have private hospital cover and your income is above a certain threshold. Its aim is to encourage individuals to take out private hospital cover to reduce demand on the public system.

You won’t pay the MLS if…

You have an appropriate amount of Hospital cover (defined as Hospital cover with an excess of $750 or less for singles, or $1,500 or less for couples and families).

If your annual taxable income is less than $101,000, or $202,000 for a couple.

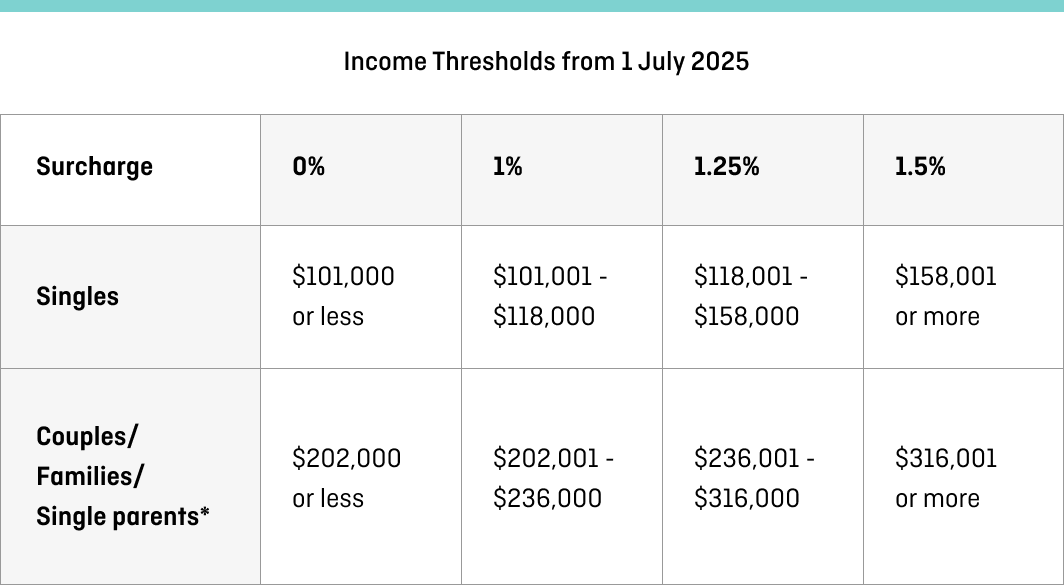

If you don’t have private hospital cover, you may need to pay the MLS if your income is above the following thresholds:

Source: www.ato.gov.au. Accurate as at 1 July 2025. The ATO may change the income tiers applicable from time to time and you can find up to date information here.

*Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first.

All Australian residents pay a contribution towards the cost of running Medicare, our national health care system. It’s called the Medicare Levy and is paid in addition to the base tax you pay on your taxable income.

The Medicare Levy Surcharge (MLS) is a tax paid in addition to the Medicare Levy if you don’t have private hospital cover and your income is above a certain threshold. Its aim is to encourage individuals to take out private hospital cover to reduce demand on the public system.

You won’t pay the MLS if…

You have an appropriate amount of Hospital cover (defined as Hospital cover with an excess of $750 or less for singles, or $1,500 or less for couples and families).

If your annual taxable income is less than $101,000, or $202,000 for a couple.

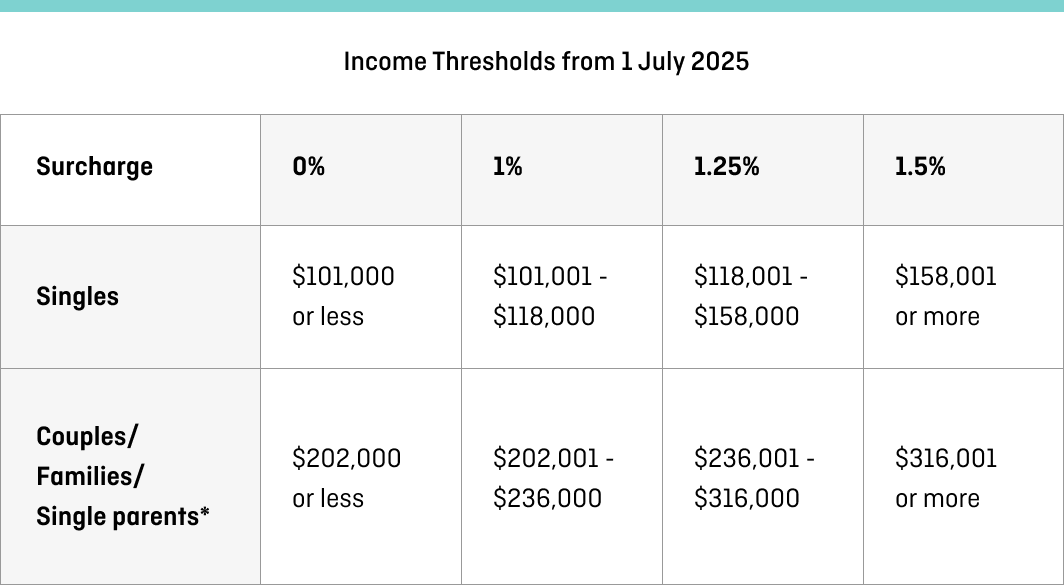

If you don’t have private hospital cover, you may need to pay the MLS if your income is above the following thresholds:

Source: www.ato.gov.au. Accurate as at 1 July 2025. The ATO may change the income tiers applicable from time to time and you can find up to date information here.

*Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first.

Why Qantas Insurance?

We offer a range of cover options to suit your needs and budget, including Hospital, Extras, and combined cover. And because we’re Qantas Health Insurance, you’ll earn Qantas Points when you initially take out a policy as well as each time you pay your premium. Plus, members can earn points for everyday activities like walking, swimming, and sleeping through the Qantas Wellbeing App.

Qantas Health Insurance is backed by nib, a provider known for its network of healthcare professionals who deliver quality care and services. In FY24, nib funded $1.88 billion in claims, approximately $5.1 million per day, demonstrating why they are our chosen partner.

Switch to Qantas Health Insurance for singles and earn Qantas Points

Important Information

Qantas Health Insurance is issued by nib health funds limited ABN 83 000 124 381 (nib) a registered private health insurer, and is arranged by Qantas Airways Limited ABN 16 009 661 901 (Qantas), for which Qantas receives commission.

It is important to be aware that health insurance will only cover the portion of costs that relate to an admission to hospital. Specialist fees outside of hospital or other outpatient fees in relation to chemotherapy or radiotherapy aren’t covered.

High cost drugs are sometimes requested for the Treatment of some cancers. Typically high-cost drugs are for newer Treatments that are not recognised by the Pharmaceutical Benefit Scheme (PBS) because the PBS considers them to be still under clinical trial and therefore experimental Treatments. Health insurance will not Cover high cost drugs for the same reasons (or may only Cover a small portion of the cost). It is the responsibility of the treating doctor, and Hospital, to inform Patients about the potential for large out-of-pockets as a result of high cost drugs.