Medicare Levy Surcharge

What is the Medicare Levy Surcharge?

The Medicare Levy Surcharge (MLS) is an additional tax on your income that you may need to pay if your income is above a certain threshold and you don’t have an appropriate level of Hospital cover as part of a private health insurance policy. Its aim is to encourage higher income earners to use the private hospital system to reduce demand on the public system.

Who has to pay the surcharge?

If you don’t have an appropriate level of private hospital cover and earn above $101,000 a year as a single or above $202,000 a year as a couple, family, or single parent, you may have to pay the MLS.

How much is the Medicare Levy Surcharge?

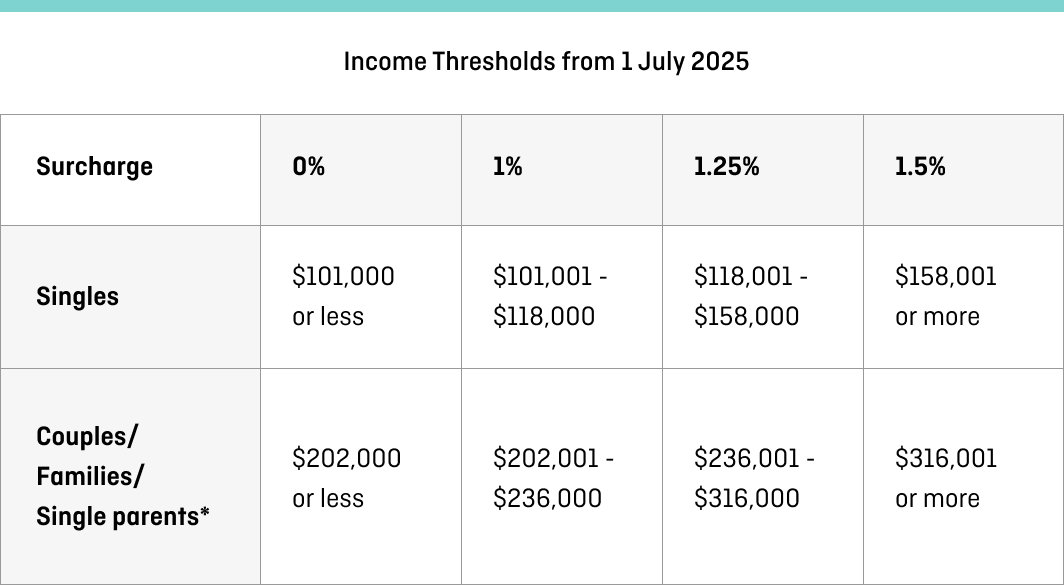

The surcharge rate increases with your taxable income, as the table below shows.

Source: www.ato.gov.au. Accurate as at 1 July 2025

*Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first.

How do I avoid paying the Medicare Levy Surcharge?

If your income is less than $101,000 (singles) or $202,000 (couples, families and single parents), then you won’t need to pay the MLS at all.

If your income is above the threshold, you can avoid paying the MLS by taking out a private health insurance policy that includes Hospital cover. The excess on your Hospital cover needs to be $750 or less for singles, or $1,500 or less for couples, families and single parents. It's important to note that Extras only cover does not help you avoid the MLS, you must hold private hospital cover.

When do you have to pay the Medicare Levy Surcharge?

If you do need to pay the MLS, you will generally need to pay it when you lodge your tax return for the relevant financial year. This means you'll usually pay it during the tax season, which runs from July 1st to October 31st. The Australian Taxation Office (ATO) will calculate your MLS liability based on your income and private health insurance status declared in your tax return. You can pay your tax liability, including the MLS, through various methods such as online via myGov or through a tax agent. Please visit the Government website for more information on paying the MLS.

Discover the Qantas Health Insurance difference

Qantas Health Insurance offers a range of Hospital cover options to choose from, plus you’ll also be rewarded with Qantas Points you could put towards your next holiday. Earn points for joining, for paying your premium, and even for fitness activities like walking, cycling and swimming through the Qantas Wellbeing App.

The content in this article is general only and is not intended to provide, and should not be relied on for, tax or accounting advice. Before making a decision, you should obtain your own current tax and accounting advice relevant to your particular circumstances.

Important Information

Qantas Health Insurance is issued by nib health funds limited ABN 83 000 124 381 (nib) a registered private health insurer, and is arranged by Qantas Airways Limited ABN 16 009 661 901 (Qantas), for which Qantas receives commission.