Waiting periods recognised

Waiting periods already served for comparable services will be recognised

We’ll help you find the right health cover for your needs and budget.

Young and single? Older and flying solo? Cover yourself so you have more freedom to explore and live life to the full.

Young couples, those thinking of kids, and older couples with differing needs can easily combine their cover.

Cover your family as they grow from newborns into early childhood, through school, teenage years and beyond.

Parenting and single? You'll discover cover for you and your kids from little bubs to teens and everything in between.

Waiting periods already served for comparable services will be recognised

Get 60%, 65% or 75% back on Extras up to your annual limit when you claim

Most of the paperwork will be taken care of for you, so you don’t have to worry

Claim on the go for most Extras either online or via the Qantas Wellbeing App

All Australian residents pay a contribution towards the cost of running Medicare, our national health care system. It’s called the Medicare Levy and is paid in addition to the base tax you pay on your taxable income.

The Medicare Levy Surcharge (MLS) is a tax paid in addition to the Medicare Levy if you don’t have private hospital cover and your income is above a certain threshold. Its aim is to encourage individuals to take out private hospital cover to reduce demand on the public system.

You won’t pay the MLS if…

You have an appropriate amount of Hospital cover (defined as Hospital cover with an excess of $750 or less for singles, or $1,500 or less for couples and families).

If your annual taxable income is less than $97,000, or $194,000 for a couple.

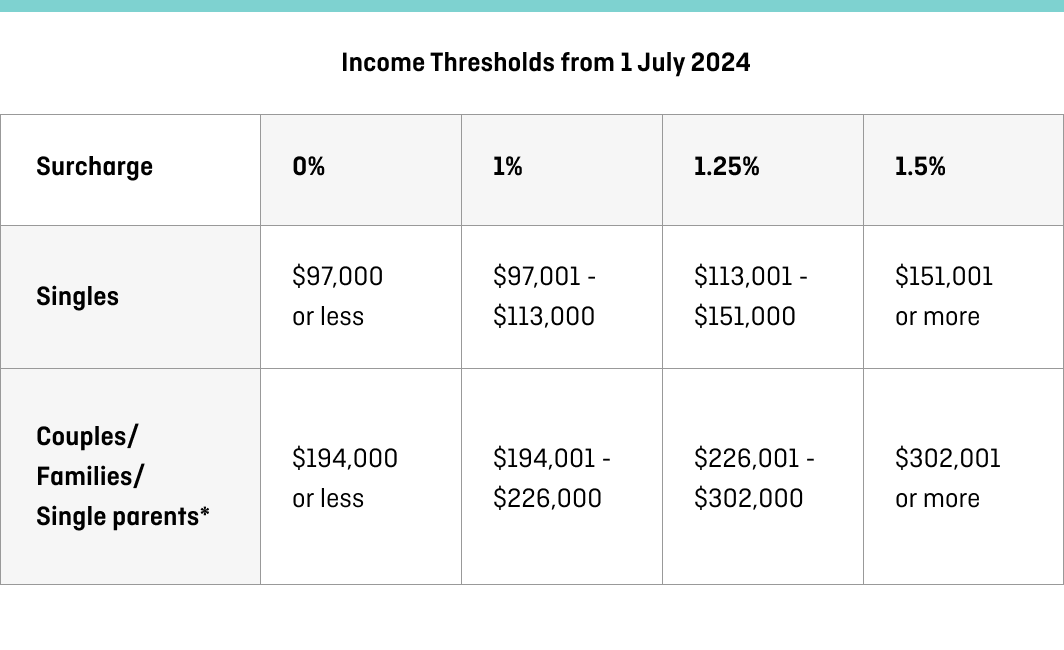

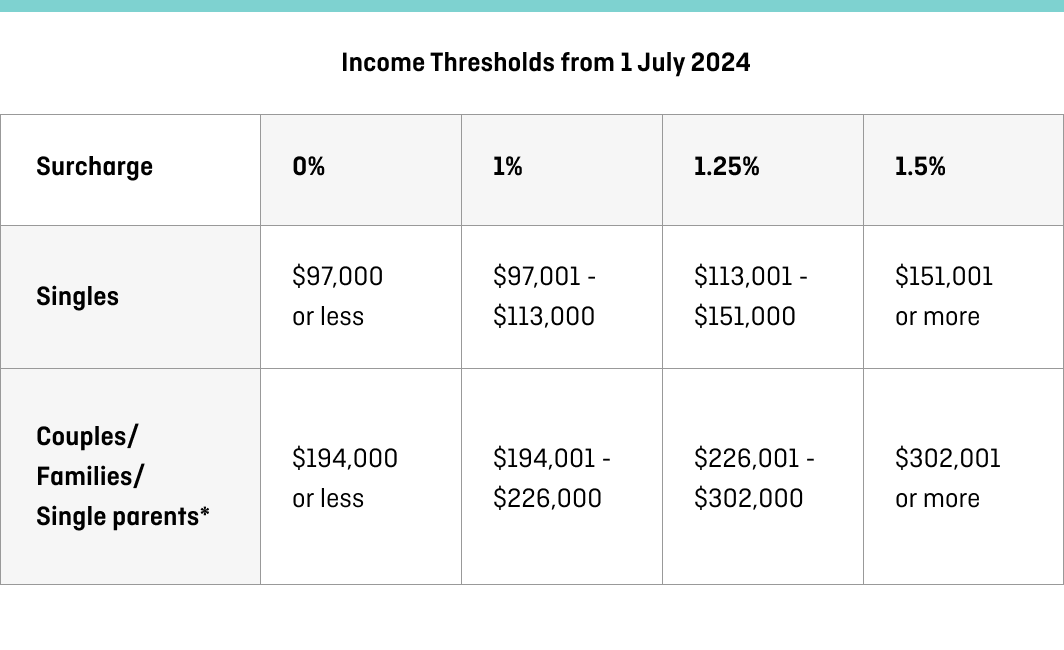

If you don’t have private hospital cover, you may need to pay the MLS if your income is above the following thresholds:

Source: www.ato.gov.au. Accurate as at 1 July 2024. The ATO may change the income tiers applicable from time to time and you can find up to date information here.

*Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first.

All Australian residents pay a contribution towards the cost of running Medicare, our national health care system. It’s called the Medicare Levy and is paid in addition to the base tax you pay on your taxable income.

The Medicare Levy Surcharge (MLS) is a tax paid in addition to the Medicare Levy if you don’t have private hospital cover and your income is above a certain threshold. Its aim is to encourage individuals to take out private hospital cover to reduce demand on the public system.

You won’t pay the MLS if…

You have an appropriate amount of Hospital cover (defined as Hospital cover with an excess of $750 or less for singles, or $1,500 or less for couples and families).

If your annual taxable income is less than $97,000, or $194,000 for a couple.

If you don’t have private hospital cover, you may need to pay the MLS if your income is above the following thresholds:

Source: www.ato.gov.au. Accurate as at 1 July 2024. The ATO may change the income tiers applicable from time to time and you can find up to date information here.

*Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first.

Qantas Health Insurance is issued by nib health funds limited ABN 83 000 124 381 (nib) a registered private health insurer, and is arranged by Qantas Airways Limited ABN 16 009 661 901 (Qantas), for which Qantas receives commission.